The United States government has long leveraged tax incentivizes (e.g. tax credits & exemptions) in its policies to spur economic development. Tax incentives allow the government to change the behavior of individuals and companies by influencing the flow of capital; for example, incentivizing taxpayers to save money, companies to move to certain geographical regions, or investors to invest in small businesses. Although tax incentives have successfully been a powerful tool they have been criticized over the years for the increased (i) complexity, (ii) lobbying, and (iii) tax fraud.

The question that is consistently asked is “do the risks and cons to tax incentives outweigh the benefits”. In this piece we will delve into one fairly uncommon tax incentive, Section 1202 Qualified Small Business Stock (QSBS), on why it is important to the economy. QSBS was infused in the tax law on September 30, 1993, as a tax exemption that encourages investors to invest in riskier stocks of innovative and technology-based early-stage startups or small businesses. QSBS rewards those investors, founders, or employees with a healthy tax exemption. QSBS was almost a deadline in the tax code up until 2010 when the exclusion was raised from 75% to 100% of capital gains tax, NIIT, and AMT on $10M or 10x the investment, and the increase was made permanent in 2015. Also, previously the 25% in nonexcludable gains were taxed at a 28% rate. Again in 2017, the Tax Cuts and Jobs Act cut the corporate tax rate from 35% to 21%, which further increased the attractiveness of the exemption.

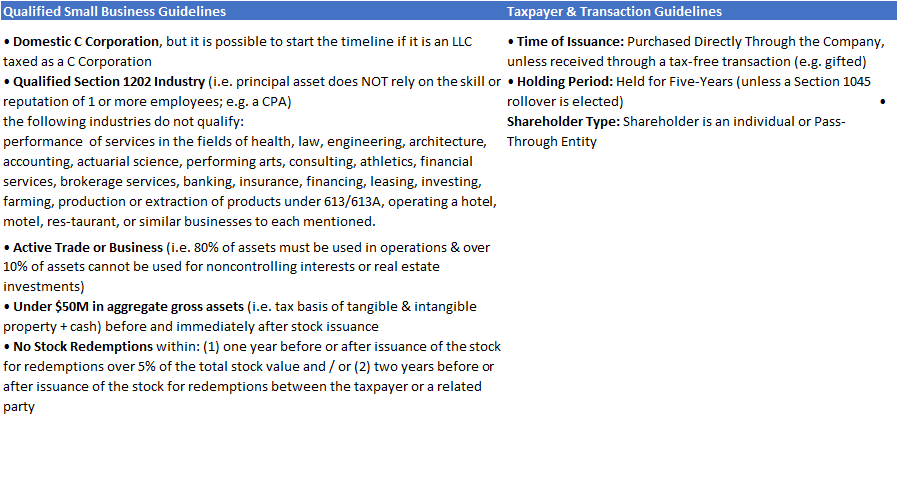

Since its enactment, QSBS has evolved from a 50% capital gains tax exclusion to a permanent 100% capital gains tax exclusion. The exclusion could have a material impact on an investor’s internal rate of return (IRR) by excluding up to 100% of the capital gains on the sale of stock owned in a qualified small business from income taxes. There is a checklist of strict guidelines to follow for the transaction, company, and stockholder to meet the requirements for the QSBS exemption, which are below:

QSBS like other tax incentives has its critics. We will walk you through deep scenarios of why QSBS is important by addressing how QSBS (a) spurs economic development, (b) increases tax revenue in the long-term, and (c) benefits the company itself and other stakeholders involved.

QSBS Spurs Economic Development

Section 1202 was structured to attract capital away from low economic growth impact investments (e.g. public stocks, index funds, or service-based companies) to innovative technology-based startups that build products that enhance society and the quality of peoples’ lives. Yes, some businesses will qualify that are not technology-based but the general mission of the tax code was geared at high-impact economic growth startups. Investing in public stocks does not promote economic growth on a macro level but a per investor level. Investing in service-based companies (e.g. restaurants) generally create lower-paying jobs and are not developing products that will enhance the efficiency of other businesses or quality of life.

Tech-based startups as opposed to general small businesses are high-growth with a long-term strategy to operate on a national or even international level, which increases the number of jobs created. Jobs created by startups are higher paying than normal business or startup jobs. On a national level, technology-based startups pay more than twice the national average wage and nearly three times the average overall startup (e.g. mom and pop small and local businesses) wage. Along with higher-paying jobs, many technology-based startups are creating efficiencies on society, business, or individual level and according to Ronald Coase’s “theory of the firm” economic systems (such as the inside of a corporation) can create lower transaction costs (i.e. where it is easier and less costly to do business routinely) can enhance economic output.

High-growth technology-based startups create new markets and increase the competition across all industries. Increased competition stimulates economic output and forces large corporations who have settled with a certain level of quality and output to either (i) become more innovative and provide new products or (ii) become an active investor in technology-based startups along with providing resources. In short, the impact of rerouting capital to innovative startups pays dividends in the long-term.

Section 1202 of the tax code has guidelines set in place so the QSBS is positioned to be a long-term incentive to spur economic growth. First, the stock must be held for five years, which incentives investors to stick with the startup and possibly be there for subsequent investments, board seats, or advising. All of these are catalysts to creating a more successful startup. The tax code does allow the stock to be sold before the five-year timeline by electing a Section 1045 rollover, but this is still incentivizing investors to reinvest the cash received into another small business.

Another way the tax code is structured to promote economic development is through its strict rules on redemptions and how the stock is acquired. The code does not allow the stock to be considered QSBS if there are stock redemptions (i) exceeding 5% of the value of all the stock within a year before or preceding the issuance or (ii) with the taxpayer or related party within two years prior or preceding the transaction. This influences founders and employees to stay with the business. This is also a requirement to keep the investor from purchasing stock and immediately selling it back to the company.

In terms of how the stock is acquired, Section 1202 only allows newly issued shares to be purchased and not stock on the secondary market. This quickly rules out public stocks. It is also a guardrail to keep capital flowing into the business and not between investors. The structure of the QSBS guidelines is proof that the exemption is not just a tax loophole for investors to cash in and cash out, especially with the fact that 90% of startups fail.

It is clear that investing in technology-based businesses stimulates the economy but does QSBS really influence investment in these high-growth, high-risk, and high return investments?

Quantifying the impact of investment tax incentives is not an easy task. Mathew Denes at Carnegie Mellon University, Xinxin Wang at the University of North Carolina, and Ting Xu at the University of Virginia analyzed data between 1988 and 2018 to conclude that investment tax incentives increase the number of angel investments and average investment size of angel investments. The same report does find that many of these investments are allocated to lower quality entrepreneurs. There is additional qualitative evidence that displays there are investors solely focused on taking advantage of tax incentives. There are venture capital / private equity funds and angel investors that are focused on investing in QSBS businesses or various investment tax credits. A few examples of funds investing are below:

- The Legacy Funds – A mobilized investment platform that is focused on regional ecosystems with a solid portion of the fund’s investment thesis focused on companies that qualify for Section 1202 and 1044.

- Verte Opportunity Fund – A early-stage venture fund that invests in early-stage high-growth startups impacting opportunity zones, which opens the door for tax advantages.

- ESO Fund – An investment vehicle that buys employee stock options and assists employees with stock related tax issues (e.g. QSBS)

- The LegalTech Fund – First investor focused solely on legal technology with an investment strategy that takes advantage of the QSBS exemption.

The QSBS exemption incentivizes high net worth individuals, PEGs, and now people who are investing in crowdfunding platforms to allocate capital to earlier-stage businesses. Privately held businesses do not have access to capital like public companies do. The government-funded tax credits and incentives can have a material impact on capital into innovative businesses, especially in states that are still in the development stage (e.g. Missouri).

QSBS Doesn’t Just Benefit Investors

Now that we know QSBS could be a catalyst to increasing investments in startups wouldn’t the tax incentive only be for wealthy investors?

The answer is no. Also, calling someone “wealthy” or “rich” is a subjective statement where one person could find that an individual making $250k+ a year is rich whereas someone else could assess rich as someone having $20M+ in net worth. For the QSBS tax exemption, multiple stakeholders can realize the tax benefits of QSBS, including employees, founders, limited partners in PE funds, angel investors, and corporations.

A good portion of startup employee’s compensation is through equity, especially in the pre-revenue stages. This can be in the form of up-front equity or shares received through a vesting schedule (e.g. RSUs, ISOs, or NQSOs). These employees obtained privately held high-growth startup stock through their commitment to the founder’s and company’s mission and vision to make a difference. Early on startup employees and founders work extra-long hours to (i) refine their product, (ii) forge a path to getting to market, (iii) raising money from investors, and (iv) building a culture and recruiting the right people. Generally, startup employees will be autonomous in the business and will take a pay cut to what they could normally make in corporate or consulting.

The equity is an incentive that startups use to make up for the lower pay, hard work, and risk employees are taking on the startup. A long-term job is not necessarily secure with startups. When startups exit or employees sell their stock options there is a high tax on the capital gain unless they qualify for QSBS and this is in addition to possible income tax for receiving the options. QSBS rewards these employees for their risk, pay cuts, and long hours towards innovating new products and ideas.

Founders are in the same boat as employees accept the first couple of years, they barely pay themselves a salary and will receive founder equity in the company for the “sweat equity”. QSBS is a tax incentive that arguably benefits founders more than any other stakeholder because they will generally have the most equity. Founders might end up exiting their startup into a new class of wealth with a large portion of founders reinvesting their gains into new ventures or starting their own funds. QSBS rewards those who are successful at building new markets and investing time and money in the future of innovation.

On an investor level, there has been a cutoff for who can invest until recently. In 1933 the Securities and Exchange Commission (“SEC”) enacted the Securities Act of 1933, which includes Rule 501(a) that has had guardrails put up for investors looking to purchase privately held stock. The Act was intended to shelter investors from investing in high-risk and low transparency private stocks by considering an “Accredited Investor” as someone who has annual income exceeding $200k ($300k for joint) for two years or a net worth exceeding $1M. It also outlines that a business development company must have assets exceeding $5M to be considered accredited. The SEC updated the Rule on August 26, 2020, by allowing investors who hold relevant credentials, designations, or certifications to qualify as well as employees of a fund. This new enactment opens the door to many new QSBS eligible investors who are not “rich”.

In addition to updating Rule 501(a), equity crowdfunding has given retail investors or everyday individuals a platform to buy and sell the privately held stock. This has grown in popularity over the last few years with $72.9M invested in quarter three of 2020 ($291.6M annualized), which is almost the entire amount raised in 2018 of $75.8M. This allows everyday people to share in the risk/reward of high-growth startups as well as take advantage of the QSBS exemption.

Tax incentives are not enacted to give rich people loopholes but are tools the government uses to create a channel that funnels cash to economic development. The exclusion increases after-tax returns by 31%, assuming investments are after 2010, and this is not including the tax savings on a state level. Increased returns equal increased capital for reinvestments. In 2019 alone, angel investors created 246k new jobs and funded over 63k new ventures. Also, angel investor-backed companies raised outside funding of $2B in 2020.

Don’t a lot of VCs and PEGs take advantage of QSBS and cost the government billions in lost tax revenue?

Not necessarily, a large portion of VC and PEG investors are nonprofits, foundations, pension funds, and endowments which do not pay capital gains taxes from the start. Pension funds AUM in 2019 was near ~$32.2T. According to Preqin pension funds currently have an average allocation of 6.4% to private equity, which equates to ~$2.1T in total private equity allocations in 2019. As of March 2020 endowments and foundations had allocated 16.9% of funds to private equity. In 2011 endowments and foundations had a cumulative $678B AUM. This would lead us to believe that total allocations to private equity could be $115B. To put these numbers in perspective, according to the Center for Venture Research the total dollars invested by angel investors in 2019 was $23.9B. Disregarding the data, even if VCs and PEGs take advantage of QSBS there is a 31%+ increase in capital to be reallocated to more investments. Investors in private equity are not one-stop-shop investors but continue allocating dollars to funds.

Another thought is that startups could have a liquidation event faster because PEGs will look to acquire the startup while the startup still qualifies for QSBS. The acquisition would have to be done through a blocker corporation or similar transaction strategy that would issue new QSBS shares. This can be argued to be mutually beneficial for the startup and the PEG because the PEG can offer capital and resources that the startup otherwise would not have had. For example, a PEG could purchase a startup to be rolled up with other synergistic portfolio companies.

Shouldn’t the Other 90% of Small Businesses be Eligible for the QSBS Exemption?

QSBS is not meant for any small business, but startups that are innovative, technology-based, and high-growth. Generally, businesses structured as LLCs, S Corps, and Partnerships are not high growth and/or innovative businesses. Mr. Viswanathan makes the argument that most businesses are not C Corps and do not see the benefits of QSBS but forgets to mention that (i) the majority of these businesses are not in a qualified industry and (ii) do not have the same tax or capital structure. His argument is also contradictory as he states the QSBS exemption should be repealed but also argues it should be allowed for all small businesses. According to the SBA’s Small Business Profile Report, 42% of small businesses under 500 employees do not even qualify for the QSBS industries. The goal of most small businesses is to bring in a stable cash flow, whereas a high growth startup is to become as big as possible which affects the economy on a national not just local level.

All other legal structures other than a C Corporation are pass-through entities, which means they do not pay taxes on the company level. C Corps are subject to double taxation (i) at the company level and (ii) when dividends are paid. This is an advantageous capital structure for tax revenue; therefore, QSBS pushes companies to be structured as C Corps. C Corps do provide benefits to founders, employees, and investors too. C Corps have stock and not member’s interest like an LLC and allow preferred stock, unlike S Corps. The C Corp structure is better for investors who want less liability than investing in common stock. C Corps also allow companies to compensate their employees through different tranches of equity. The term is Qualified Small Business “Stock” not equity and is structured to be used for stock, not member’s equity. Also, pass-through businesses receive the Section 199A QSB deduction, which is not given to C Corps. For simplicity, QSBS would not correlate well with other legal structures and would cause headaches for the IRS and other tax professionals to deal with.

QSBS Can Increase Tax Revenue in the Long-Term

Manoj Viswanathan’s piece on Section 1202 QSBS (The Qualified Small Business Stock Exclusion: How Startup Shareholders Get $10 Million (or More) Tax-Free)), argues that any technology startup to IPO with an initial market cap of $10B will result in $800M in excludable QSBS gains. This is simply a dramatic exaggeration to make QSBS look as unfair as possible. Indeed, investors, employees, and founders who are stuck with a startup to IPO will likely get a large tax break, but if a startup makes it to the IPO finish line the exemption has done its job. For example, five of the most notable technology IPOs in 2020 (Palantir, Mcaffee, Asana, Snowflake, & ZoomInfo) cumulatively employed over 13.5k individuals with sales at $4.1B. Each of these companies will accumulate sales tax (some may not), corporate income tax if profitable, and payroll tax in perpetuity, whereas the QSBS exemption, is a one-time per company basis (in most cases).

Also, in the article, Mr. Viswanathan states that the Joint Committee on Taxation (“JCT”) estimates that QSBS will equate to $1.1B to $1.3B in lost tax revenue in 2019. Therefore, he is assuming that one transaction can account for 70% of cumulative QSBS exemptions. Regardless of the amount, the tax dollars lost to QSBS exemptions are minuscule on a macro level. The US government collects roughly $4.7T in income and payroll taxes every year. According to the IRS’s tax database in 2012, there were ~$845B in capital gains reported alone. Even though there is lost tax revenue this goes back to a theme in this article, the QSBS exemption is an incentive to not only spur initial investment but continuous reinvestments. The tax break increases the IRR on the investment and gives investors more capital to allocate to additional investments, creating a cycle of economic development.

The successful companies who are QSBS eligible will create many high-paying jobs, which produces higher individual income tax and payroll taxes. More jobs and an increase in the average salaries and wages stimulate the economy, creating a domino effect of dollars being spent. The domino effect is that increased high-earning jobs will bring in far more tax than a one-time QSBS exemption. The companies selling directly to consumers will bring in sales taxes and the profitable business will pay corporate income tax as well as taxed dividends if the company is public. One caveat that has not been addressed is that most states (43) allow the QSBS exemption but California does not. Partly due to the QSBS exemption California can leverage a capital gains state income tax rate of 13.3%, which is the highest of any state. California is home to 42% of all venture capital investments in the US and 30% of all exits, which allows the state to reallocate the success of venture and innovation to the general public throughout the state (e.g. funding new roads and projects).

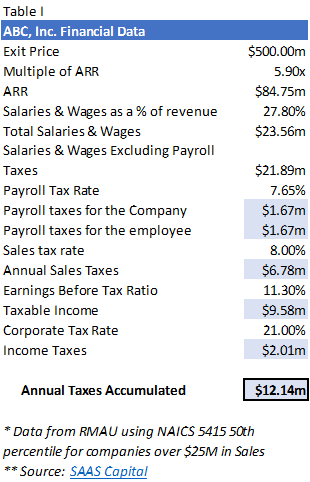

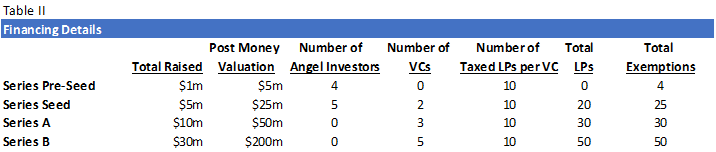

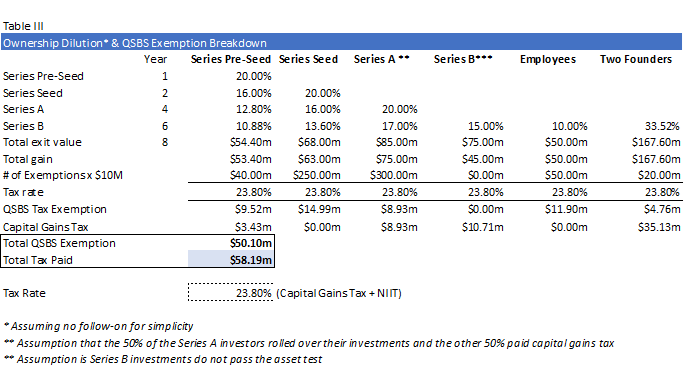

We have put together a short case study to display that the future tax revenue from a QSBS startup exit is more than the lost tax revenue of the QSBS exemption. We based our case on a fictitious company, ABC, Inc. (“ABC” or the “Company”), which is direct to consumer information technology company. The Company recently exited to a strategic buyer for $500M or 5.90x revenue, which implies an annual recurring revenue (ARR) of $84.75M. We forecasted taxes to be paid as a direct correlation to the Company’s operations as sales tax, payroll tax, and income tax for a total tax amount of $12.14M (shown in Table I).

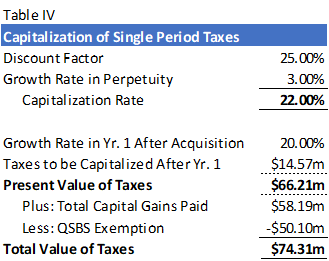

After calculating the total tax dollars that will be received and exempt, we capitalized the tax dollars that will be received in perpetuity from the Company’s operations. We assumed the business would have 20% growth in the year after the exit; therefore, the taxes directed from operations would be $14.57M ($12.14M x (1 + 20%)). We used the Gordon Growth model to capitalize on these assumed taxes, using a 3.00% long-term growth rate and a 25% discount rate. This implies a capitalization rate of 22.00% (25.00% – 3.00%) and a present value of tax revenue in perpetuity of $66.21M. To determine the total value of tax revenue post transaction we deducted the taxes related to the QSBS exemption and added the capital gains taxes that were not excluded for a total value of taxes of $74.31M (shown in Table IV). This implies that even though there were capital gains exempt from income tax the startup still provides more value on a macro level rather than viewing the company on a transactional level. The lost tax revenue is nearly an incentive for future stimulants of economic growth, which increases tax revenue.

Concluding Thoughts

QSBS’s critics have made reasonable arguments for why QSBS should be repealed but have only looked at the tax incentive through pessimistic lenses. The critics are right that tax revenue is lost due to the incentive and a good portion of the revenue is lost to tax payer’s in higher tax brackets, but that would indicate the incentive is being used and not a dormant piece of the tax code like it was before 2010. It is not easy to give evidence of the impact of a tax incentive but we have given a few facts that display why QSBS (a) spurs economic development, (b) increases tax revenue in the long-term, and (c) benefits the company itself and other stakeholders involved. Although there may be some outliers that take advantage of the tax code that like with any tax incentive, QSBS is a tool that has been a proven stimulate for economic development. Section 1202 was written 28 years ago not to deprive the government of tax revenue but as a way to incentivize investors to allocate capital to innovative high-risk businesses as well as reward those founders and early-stage employees for their effort in changing society!

This article does not constitute legal or tax advice. Please consult with your legal or tax advisor with respect to your particular circumstance.