Include QSBS clauses in your agreements to better manage your QSBS

With an increased emphasis on qualifying and maintaining Qualified Small Business Stock (QSBS) status, investors have increasingly requested that QSBS reps and covenants are included in agreements.

This page includes resources to help investors and corporations better understand the types of clauses that have been utilized and contains example clauses to consider incorporating.

Terms Sheets

- A term sheet is a nonbinding agreement setting forth the basic terms and conditions under which an investment will be made. It serves as a template to develop more detailed legally binding documents.

- The launch of QSBS Expert’s tech-enabled system to manage QSBS provides investors the opportunity to request that companies they invest in monitor their QSBS status and companies with a reasonable method to do so.

- In addition to requests such as (i) annual and / or quarterly unaudited or audited financial statements, (ii) notice of all suits, claims, proceedings or investigations that could materially and adversely affect the Company, (iii) other information or documents reasonably requested by the Investor at reasonable times and intervals concerning the general status of the Company’s financial condition and operations, Information Rights covenants within financing documents can include the following or similar language.

Example Language

Information Rights: For so long as the Investor or any of its Permitted Assignees (as defined herein) holds any Equity Securities of the Company (including the SAFE), the Company shall deliver to the Investor the following:

(a) Prior to the closing of this financing, the Company shall conduct a reasonable investigation to determine whether the Company qualifies as a “qualified small business” within the meaning of Code Sections 1045 and 1202, and that the Company transmit, in writing, the results of such investigation to Investor as expeditiously as reasonably possible.

(b) As soon as practicable after the end of the first, second and third quarterly accounting periods in each fiscal year of the Company, and in any event within forty-five (45) days after the end of the first, second, and third quarterly accounting periods in each fiscal year of the Company the Company shall update their investigation to determine whether the Company continues to qualify as a “qualified small business” within the meaning of Code Sections 1045 and 1202, and shall transmit, in writing, the results of such investigation to Investor as expeditiously as reasonably possible, but in no event later than 15 days following the Company’s receipt of such request.

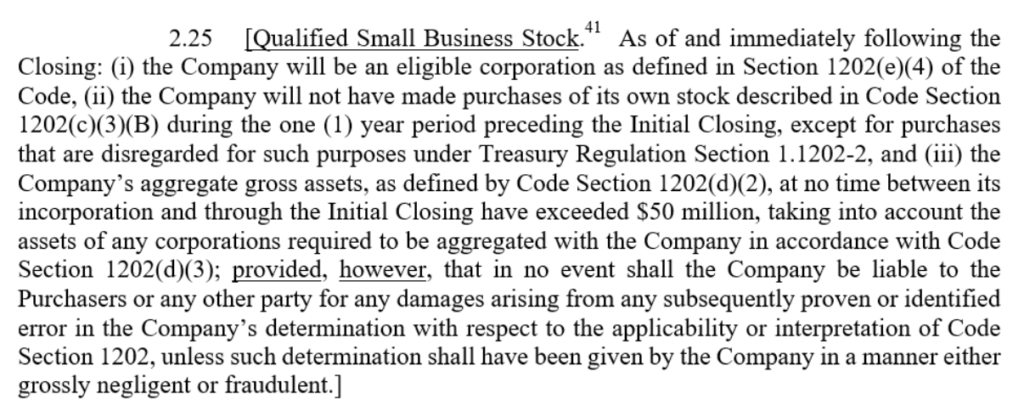

Share Purchase Agreements

- A stock purchase agreement is a legal contract between a buyer and a seller detailing the mutually agreed upon terms of the transaction.

- They may contain QSBS representations such as “the Shares, to the Company’s knowledge, constitute “qualified small business stock” within the meaning of Section 1202 of the Internal Revenue Code of 1986, as amended.”

- Refer to the National Venture Capital Association website for model documents. The model SPA contains the following QSBS representation:

Investor Rights Agreements

- An IRA outlines the rights and privileges stockholders are entitled to receive. It may contain:

- QSBS reps similar to those in Share Purchase Agreements.

- QSBS covenants such as “Company shall not take, or fail to take, any action which would cause the stock to fail to qualify as “qualified small business stock” within the meaning of Sections 1045 and 1202 of the Code provided that, notwithstanding the foregoing, the Company shall not be obligated to

- (A) take any action, which in its good faith business judgment, is not in the best interests of the Company or its stockholders or

- (B) refrain from taking any action, which in its good faith business judgment, is in the best interests of the Company or its stockholders”

- A requirement for the company to perform an analysis of the QSBS qualifications of stock at the request of a shareholder. Refer to this article for further details.

For an example, refer to Poshmark’s IRA, including the ‘Certificate of Representations Regarding QSBS’ in Exhibit B.

This article does not constitute legal or tax advice. Please consult with your legal or tax advisor with respect to your particular circumstance.