Have you already or do you expect to sell your QSBS stock, but have not met the required 5-year holding period?

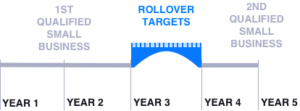

Through IRC Section 1045, QSBS holders can “rollover” gains into another Qualified Small Business, ‘tacking’ the holding period to continue to work towards meeting the 5-year holding period – however you only have 60 days from the date of your gain to complete your rollover.

So, where can you find other Qualified Small Businesses raising right now? Complete the following form and we will be in touch with opportunities.

5-Year Holding Period for QSBS Eligibility

This article does not constitute legal or tax advice. Please consult with your legal or tax advisor with respect to your particular circumstance.