Unsure if your stock is QSBS? Check your potential eligibility here.

As a holder of qualified small business stock (QSBS) it is important to know what steps to take not only when you report the Section 1202 exclusion on your taxes but also when the QSBS is issued. QSBS for some is a hidden secret embedded within the internal revenue code that can be the silver bullet to saving a taxpayer millions of dollars in capital gains taxes on a federal and in some cases a state level. Because Section 1202 is a rare tax incentive it can increase the chances of an audit, which is why it is important to collect all of the documentation at the time of QSBS issuance and throughout the holding period to fortify that the stock and taxpayer pass all items on the QSBS checklist. Below are the documents to gather.

- Articles of Incorporation

- Stock Purchase Agreement

- At issuance: Opinion Letter from a Tax or Legal Professional and Tax Returns (if possible)

- After issuance: Opinion Letter from a Tax or Legal Professional and Tax Returns (if possible)

- A Stock Sale and Purchase Agreement:

* The documentation needed and filing instructions will change if your QSBS was acquired through a Section 1045 rollover, which is outside the purview of this document.

After selling QSBS and having a recognizable gain there will either be a form/statement received with your gain or no form at all. It depends on whether the QSBS was purchased through a pass-through entity, sold through a broker, sold back to the company, or the company was acquired. Below are the various forms or statements that could be received.

- Form 1099-B

- Form 1099-DIV

- Form 1099-CAP

- Form 1099-MISC

- Schedule K-1

Next determine what your excludable gain is based on the year it was purchased (e.g. 50%, 75%, or 100%) and the tax exclusion cap (i.e. $10 million or 10x the initial investment) to report on the forms below.

- Form 8949

- Schedule D

- Form 1045

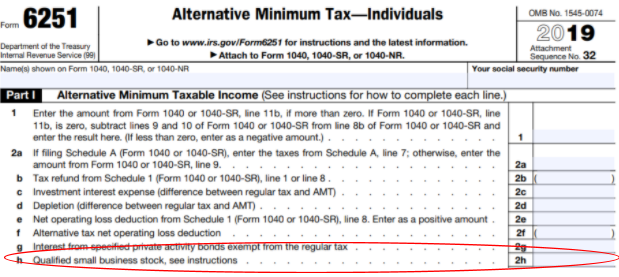

- Form 6251 (if purchased before September 27, 2010)

- Form 8960 (if there is a portion of the gain that is not excludable)

The takeaway is that the Section 1202 gain only takes a few steps to report on your tax return but it is important the correct documentation collected to (i) determine the right gain exclusion and (ii) have tangible proof that the stock does qualify as QSBS.

Documentation

To file for qualified small business stock (QSBS) on an individual return there is no required documentation to be attached to the return, but it is imperative that the taxpayer has documented proof of Section 1202 QSBS qualification when the stock is purchased as well as records throughout the holding period. Even if the taxpayer believes his/her stock qualifies for the Section 1202 gain exclusion there is a 20% penalty for taxes underpaid if there was no effort to document the QSBS eligibility. If the taxpayer is receiving Section 1202 gains from a pass-through entity (PTE) the PTE will need to attach a statement for each sale or exchange, including (a) the name of the corporation that issued the QSB stock, (b) the partner’s share of the partnership’s adjusted basis and sales price of the QSB stock, and (c) the dates the QSB stock was bought and sold. The PTE will also need to gather the correct documentation at the issuance of QSBS and until it is sold. It is helpful and not unusual if the QSBS issuing company adds a clause in the stock purchase agreement saying that the company qualifies for QSBS and will do everything it its power to maintain the qualification so long it does not impede the businesses operations. Below is a list of documentation to maintain and when the documentation should be collected.

Obtain on the Date the Stock is Issued/Purchased

- Articles of Incorporation: Displays that the company was founded as a domestic C Corporation or was a domestic C Corporation when the QSBS was issued.

- Stock Purchase Agreement: Displays the date the stock was issued/purchased, the original basis of the stock, the stock was purchased directly from the company, and any clause stating the company qualifies as qualified small business under Section 1202. The date the stock was purchased is important for determining (i) the holding period, (ii) the tax exclusion, and (iii) the original basis for determining gain after the sale as well as the basis for the tax exclusion. Below are the tax exclusions by date the stock was purchased.

- After August 10, 1993, but before February 17, 2009: 50%

- After February 17, 2009, but before September 27, 2010: 75%

- After September 27, 2010: 100%

- Opinion Letter from a Tax or Legal Professional and Tax Returns (if needed): Displays that the company was always under $50 million in aggregate gross assets after August 10, 1993 and immediately after the issuance of the taxpayer’s QSBS, meaning the investment cannot put the company above $50 million. A statement or stock registry showing that there have been no stock redemptions by the company over a de minimis amount within a 1- or 2-year time period before issuance. The letter should also include a statement that the company is an active business using 80% of its assets in a qualified Section 1202 industry and has no greater than 10% of its assets in long-term investments (under 50% owned subsidiary, real estate, or non-operating assets). *exceptions may apply to the active rule and stock redemptions

After Issuance/Purchase but Before Sale

- Opinion Letter from a Tax or Legal Professional and Tax Returns (if possible): A statement or stock registry showing that there have been no stock redemptions by the company over a de minimis amount within a 1- or 2-year time period after the issuance. A statement that the company used 80% of its assets in a qualified Section 1202 industry and has no greater than 10% of its assets in long-term investments (under 50% owned subsidiary, real estate, or non-operating assets) for the majority of the taxpayer’s holding period. *exceptions may apply to the active rule and stock redemptions

- A Stock Sale and Purchase Agreement: Displays the date the QSBS was sold and proceeds received. This allows the taxpayer to determine if they hit the five-year holding period and if not, whether to plan for a Section 1045 rollover. Also, it displays to the proceeds from the sale so the recognizable gain can be determined to calculate whether the gain exceeded the $10 million or 10x the initial investment exclusion cap.

*If the taxpayer’s QSBS was purchased from a Section 1045 rollover then there is double the documentation needed to be maintained. The above documentation would be needed for the original QSBS and the replacement QSBS from the Section 1045 rollover.

Filing for Section 1202

Reporting Section 1202 on an individual tax return requires two main steps, reporting the gain and exclusion on Schedule D and Form 8949. The capital gains will either need to be calculated by the taxpayer or the taxpayer’s accountant to report or to benchmark if one of the six forms are received (i) Form 1099-B (ii) Form 1099-DIV, (iii) Form 2439, (iv) Form 1099-CAP, (v) Form 1099-MISC and (vi) Schedule K-1. It is unusual to receive a tax form on the sale of private stock, but there are unique situations where it may happen. Below are the reasons for receiving each form.

- Form 1099-B: Taxpayer sells his/her stock through a broker or a barter exchange transaction

- Form 1099-DIV: Taxpayer owns QSBS through a bank or other financial institution (e.g. regulated investment company (RIC), real estate investment trust (REIT), or mutual fund) and the institution is distributing gains to the taxpayer.

- Form 2439: Taxpayer owns QSBS through a RIC or REIT and the institution has undistributed gains to the taxpayer.

- Form 1099-CAP: Taxpayer is a shareholder of a QSBS corporation that has had a controlling interest acquired or has undergone a substantial change in capital structure.

- Form 1099-MISC: It is very unusual for a taxpayer to receive this form, but there are some cases it can happen (e.g. a company repurchases stock from the taxpayer).

- Schedule K-1: Taxpayer holds ownership interest in a PTE that sold QSBS.

Regardless if one of the above forms is received or not, QSBS has to be reported on Schedule D and Form 8949.

Section 1202 Reporting on Form 8949

Form 8949 is the first form to fill out when reporting a gain on the sale or exchange of Section 1202 QSBS. On page 2 part II of the form the under long-term transactions the Section 1202 gain and exclusion are reported. In column (f) there needs be a “Q”, which means the transaction is involving a Section 1202 gain exclusion. Also, check the (f) box if you did not receive a Form 1099-B.

Section 1202 Reporting on Schedule D

After filling out Form 8949, the numbers should flow through to certain lines on Schedule D. On the 28% rate gain worksheet line 2, which is line 18 on Schedule D, Part III, fill out the amount the gain that is not excludable from form 8949. The form states “1/3 of any section 1202 exclusion reported in column (g) of Form 8949, Part II”, meaning that you should report the 25% portion of the gain (1/3 x 75% = 25%). This section is solely for stock acquired before September 27, 2010. The amount that is over the 100% exclusion will need to be reported on line 2 and taxed under the max capital gains rate of 28%.

Then enter this amount on line 14 of the Unrecaptured Section 1250 Gain Worksheet, which is line 19 on Schedule D, Part III.

On Form Schedule D the same boxes as Form 8949 will need to be filled out.

Below is where the numbers on the 28% rate gain worksheet and Unrecaptured Section 1250 Gain Worksheet flow to.

Section 1202 Reporting by Form or Sale Type

- Form 1099-B: On Form 8949 there are four different boxes that can be checked based on whether (i) box 2 on the 1099-B is checked for short- or long-term gain and (ii) it was or was not reported to the IRS. If box 2 is blank and code X is in the “Applicable checkbox on Form 8949” box near the top of Form 1099-B, your broker doesn’t know whether your gain or (loss) is short term or long term. Use your own records to determine whether your gain or (loss) is short term or long term. In column (a) of Form 8949, Part II, you will enter the name of the corporation sold. Also, on Form 8949, you will enter in column (f), “Q,” and in column (g), the amount of the excluded gain as a negative number. On line 18 & 19 of Schedule D, enter as a positive number the amount your Section 1202 exclusion does not cover on line 2 of the 28% Rate Gain Worksheet.

- Form 1099-CAP: The proceeds from the sale or exchange of stock will be in box 2 of the form, which will be reported onto Form 8949 and Schedule D the same as the directions above.

- Form 1099-DIV: Section 1202 gain will appear in box 2(c) of the form and will be reported on Schedule D, line 13, of your individual tax return. On line 18 & 19 of Schedule D, enter as a positive number the amount of your allowable exclusion on line 2 of the 28% Rate Gain Worksheet. In column (a) of Form 8949, Part II, you will enter the name of the corporation sold. Also, on Form 8949, you will enter in column (f), “Q,” and in column (g), the amount of the excluded gain as a negative number. On line 18 & 19 of Schedule D, enter as a positive number the amount your Section 1202 exclusion does not cover on line 2 of the 28% Rate Gain Worksheet.

- Form 1099-MISC: The QSBS will be displayed in box 3 “other income” of the form. In column (a) of Form 8949, Part II, you will enter the name of the corporation sold. Also, on Form 8949, you will enter in column (f), “Q,” and in column (g), the amount of the excluded gain as a negative number. On line 18 & 19 of Schedule D, enter as a positive number the amount your Section 1202 exclusion does not cover on line 2 of the 28% Rate Gain Worksheet.

- Form 2439: In box 1(c) of the form, the Section 1202 gain will be reported and box 1(a) will include the full gain. Report the full gain from box 1(a) on Schedule D, line 11. In column (a) of Form 8949, Part II, you will enter the name of the corporation sold. Also, on Form 8949, you will enter in column (f), “Q,” and in column (g), the amount of the excluded gain as a negative number. On line 18 & 19 of Schedule D, enter as a positive number the amount your Section 1202 exclusion does not cover on line 2 of the 28% Rate Gain Worksheet.

- Schedule K-1: QSBS gains received through a pass-through entity will be reported on line 10 of the k-1 received through the 1120S (S Corporation) or line 11 of the k-1 received through a 1065 (Partnership) tax return. Attached to the k-1 will be a statement for each sale or exchange (a) the name of the corporation that issued the QSB stock, (b) the partner’s share of the partnership’s adjusted basis and sales price of the QSB stock, and (c) the dates the QSB stock was bought and sold.

*The k-1 gain will be reported the same as the gains are reported under section

- Installment Sale Reporting: If the QSBS gain is received in an installment sale than the sale will be reported on Form 6252. The long-term gain reported on Form 6252 will be also be reported on line 11 of Schedule D. You will have to determine the eligible gain each year of the installment to be reported by multiplying the exclusion by a percentage of the gains received each year of the installment schedule. In column (a) of Form 8949, Part II, you will enter the name of the corporation sold. Also, on Form 8949, you will enter in column (f), “Q,” and in column (g), the amount of the excluded gain as a negative number. On line 18 & 19 of Schedule D, enter as a positive number the amount your Section 1202 exclusion does not cover on line 2 of the 28% Rate Gain Worksheet.

Alternative Minimum Tax Reporting for Section 1202

All taxpayers will report alternative minimum tax (AMT) on Form 6251 if your stock was purchased before September 28, 2010. Multiply the excluded gain (as shown on Form 8949 in column (g)) by 7% and enter the result on line 2(h) of Part 1 as a positive amount.

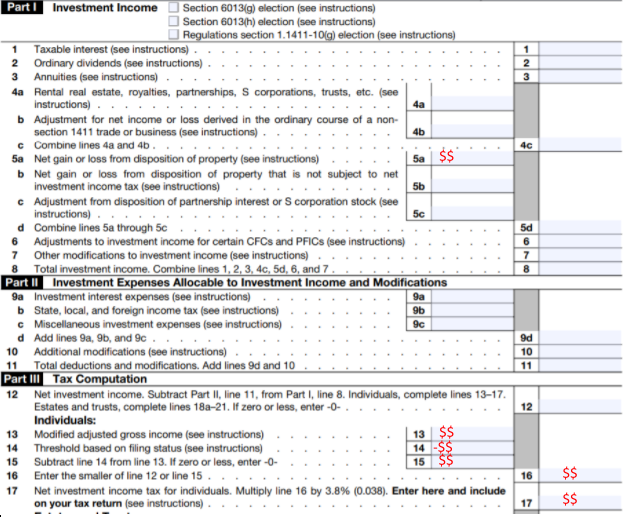

Net Investment Income Tax Reporting for Section 1202

Net investment income tax (NIIT) is a 3.8% tax owed when a taxpayer’s modified adjusted gross income (MAGI) exceeds a threshold amount. MAGI is adjusted gross income (AGI) from line 8(b) on the face of Form 1040. AGI is calculated by taking gross income minus deductions. MAGI is AGI plus any foreign income tax exclusions taken (e.g. exclusions from Section 2555 or any CFCs & PFICs owned). Below are the MAGI thresholds if NIIT must be filed.

| Filing Status | Threshold Amount |

| Married filing jointly | $250,000 |

| Married filing separately | $125,000 |

| Single | $200,000 |

| Head of household (with qualifying person) | $200,000 |

| Qualifying widow(er) with dependent child | $250,000 |

After the taxpayer has determined they have to pay NIIT, they will report the investment income from the non-excluded QSBS gains on line 5(a), Part I, of Form 8960. Any investment expenses will be deducted in Part II. Next the MAGI will be reported on line 13, Part III, with the taxpayer’s NIIT threshold subtracted on line 15, Part III, with the smaller of the QSBS gain or the MAGI minus the threshold taxed at a 3.8% rate.

Unsure if your stock is QSBS? Check your potential eligibility here.

This article does not constitute legal or tax advice. Please consult with your legal or tax advisor with respect to your particular circumstance.