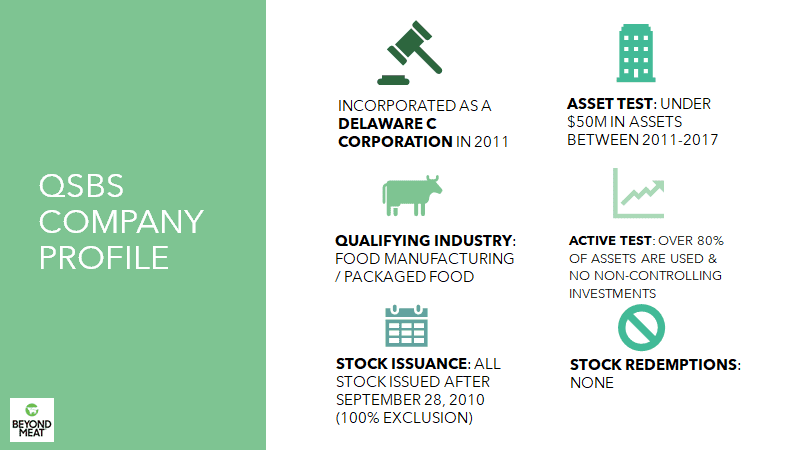

The purpose of this case study is to give a real-world example of the potential benefits of the Section 1202 qualified small business stock (QSBS) exclusion on a QSBS holder and tax revenue level. Below is the QSBS Company Profile for Beyond Meat (“the Company” or “BM”) displaying that the company passes all tests to have been a qualified small business.

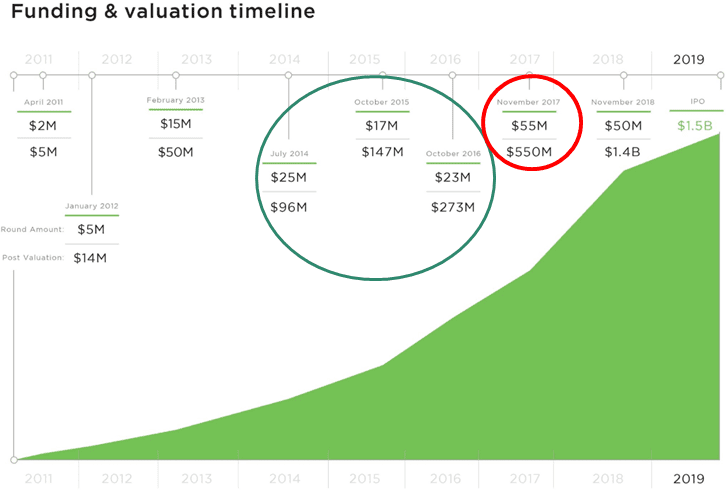

The Company passes the Section 1202 qualified small business test between 2011 – 2017. The reason the company does not qualify past 2017 is because they raised $55M, which pushed it over the $50M gross asset test threshold.

The Post-Money Valuations below how the capital raises prior to 2017 did not affect the asset test, because they are merely a fair value that investors are willing invest at and the Company did not exceed the $50mm total gross asset threshold prior to 2017 – the Company’s total asset balance per its balance sheet as of December 31, 2016 were $34.9 million.

Investor in an Investment Fund

As an example of how QSBS benefits an investor, Kleiner Perkins held approximately 16% ownership of the Company pre-IPO, having participated in the Company’s early stage financing rounds in 2011, 2012, 2014, and 2015.

All of Kleiner’s investments qualified for Section 1202 QSBS, because the company met the qualified small business test each of those years.

Although it has multiple investments each limited partner of the fund faces the higher of the $10 million or 10x tax exclusion limitation, but the basis for the 10x exclusion is cumulative of each investment.

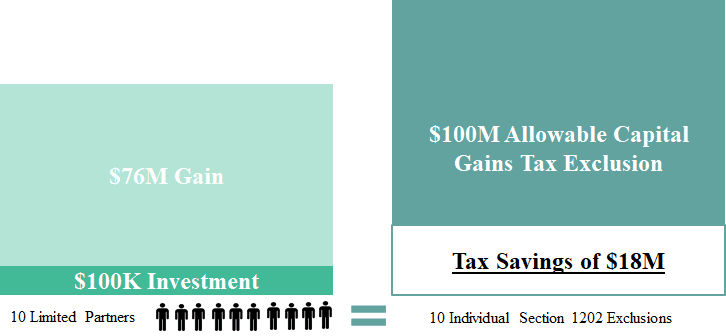

Suppose Kleiner’s initial Series A investment in 2011 was $100k and the fund exited that invesment at the end of the first day of trading when the market cap was $3.8B. According to Cromwell Schubarth, of Silicon Valley Business Journal, the initial investment after dilution was around a 760x return; therefore, the $100k would have been worth $76M. Although this gain is over the $10M or 10x Section 1202 tax exclusion it is not for purposes of distributing each gain to individual LPs. We used a hypothetical number of 10 LPs for our example. Below is a demonstration.

Each LPs distribution would come through their partnership K-1 from Kleiner Perkins. The tax savings of $18M was calculated by taking $76M x the hightest capital gains rate of 20% plus the 3.8% of net investment income (NIT) tax ($76M x 23.8%).

Investment Fund Carried Interest

Now taking a step further to account for carried interest (profits interest) of the Managing Partners at Kleiner Perkins. Currently, Kleiner Perkins has five Managing Partners and lets assume that those five split a carried interest of 20% or 4% for each partner. The total carried interest would be $18M ($76M x 20%). Split four ways is $4.5M each partner. Carried interest is excludable under Section 1202; therefore, each partner can utilize their own $10M gain exclusion, paying no taxes on the $4.5M carried interest.

Founder

At the time of the Company’s IPO, Founder & CEO, Ethan Brown owned 6.4% of the Company at a value of $78M. As the founder of a startup company, his basis in the shares issued to him is either zero or very close to nothing. Assuming Mr. Brown has no basis in his stock we will use the $10M gain exclusion to calculate what his savings could have been if he sold after the IPO. If Mr. Brown sells his stock immediately before the IPO he would have a realized gain of $78M with an exclusion up to $10M or $2.38M ($10M x 23.8%) in taxes. Tax payment calculation below:

With QSBS: $78M – $10M x (20% + 3.8%) = $16.2M

Without QSBS: $78M x (20% + 3.8%) = $18.5M

This article does not constitute legal or tax advice. Please consult with your legal or tax advisor with respect to your particular circumstance.