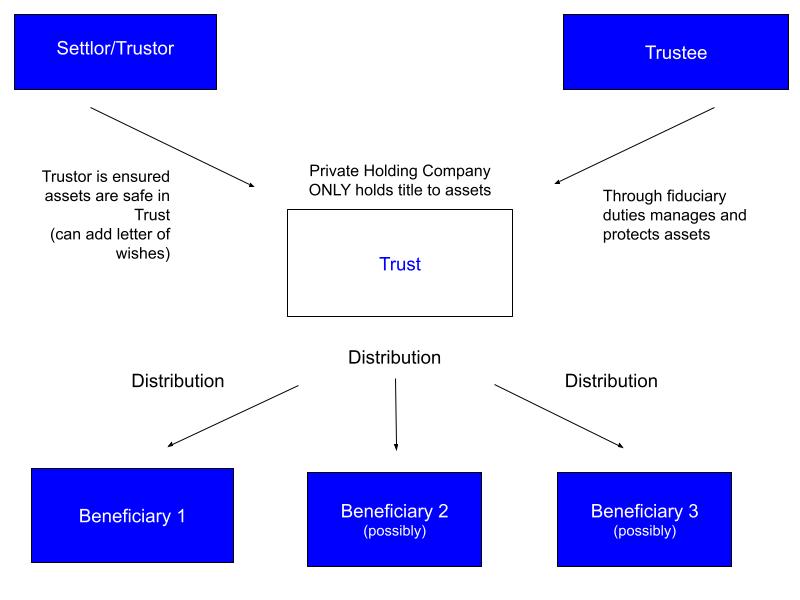

A trust is between a trustor (the one who gives the right to hold title to assets/property) and a trustee (the one who receives the title to said asset/property). This situation creates a fiduciary relationship which comes with fiduciary duties, such as:

- Duty of Care

- Duty of Confidentiality

- Duty of Loyalty

- Duty of Obedience

- Duty of Accounting

Granted, the trustee only has the right to hold title to the asset/property because the benefit will eventually go to a third party, known as the beneficiary. Trusts are created for several reasons, most are subjective to the trustee. These include:

- Legal protection for the trustee’s assets

- Distributed to the beneficiaries upon trustee’s original wishes

- Time efficient

- Reduce or claim exemption on estate taxes

- Most of the time, to protect minors of financial obligations until they reach a specific age set forth in the rules set by the trustor

Purpose Behind a Trust

Trusts are known to be very versatile when it comes to who can create one and who can receive. The only discretionary factor is how much the individual wants to spend on lawyer fees and time spent. The creation of a trust is to ensure the trustor’s assets/property will be as safe as can be with a legal entity(trustee) rather than in a relatives hands—this may be due to some unforeseen circumstances like divorce, new home, job misfortunes, etc..

Trust can be used for privacy, estate planning, security, however in our point of view, we will be focusing on trusts being created for tax planning purposes.

Trust as Tax Planning Purposes

Tax planning using the vehicle of a trust has been a popular topic because the tax consequences from using trust are substantially lower than some other tax planning alternatives (i.e. reducing overall income through donations, increasing the number of tax deductions, etc.). The trustor’s assets that were held by a trustee for years can end up having substantial tax savings once the beneficiary receives the title due to the assets benefiting from a step-up basis. A “Step-up Basis” is,

“…[T]he readjustment of the value of an appreciated asset for tax purposes upon inheritance.”

Trust Used as Tax Planning Strategies

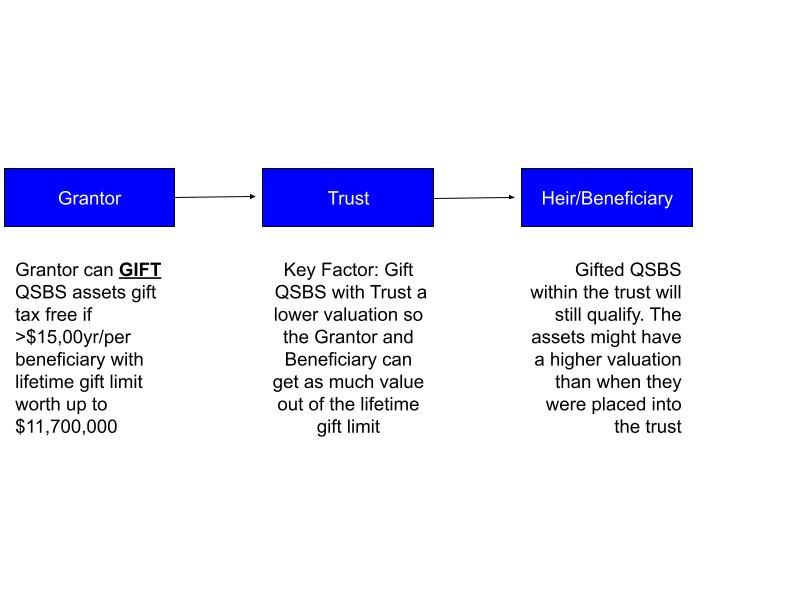

The first “Advanced Equity Planning Strategy” surrounds the Irrevocable Non-Grantor Trust. A founder can gift QSBS to a child or beneficiary through a trust that can qualify for its own Section 1202 exemption. This type of trust is generally meant for children or future heirs. The original owner of the qualified stock is considered the grantor and when the QSBS is gifted (rather than sold) using the strategy, the stock maintains its QSBS eligibility.

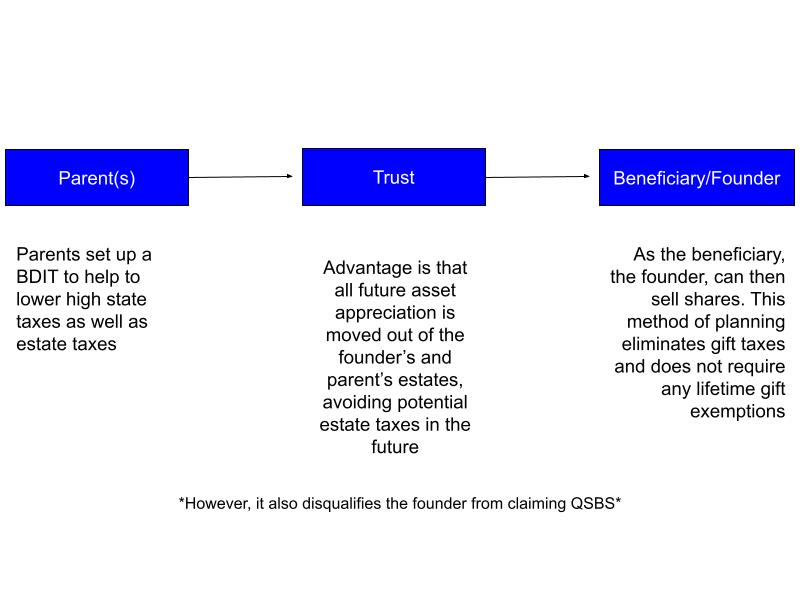

The second “Advanced Equity Planning Strategy” surrounds the Parent-Seeded Trust, also known as Beneficiary Defective Inheritor’s Trust (BDIT). The beneficiary defective inheritor’s trust (BDIT) is an effective estate planning strategy that lets you get the benefits of a typical trust without relinquishing control of your assets. You can continue to manage and use the assets in the BDIT without jeopardizing the trust’s ability to lower the transfer taxes and protect assets from creditors.

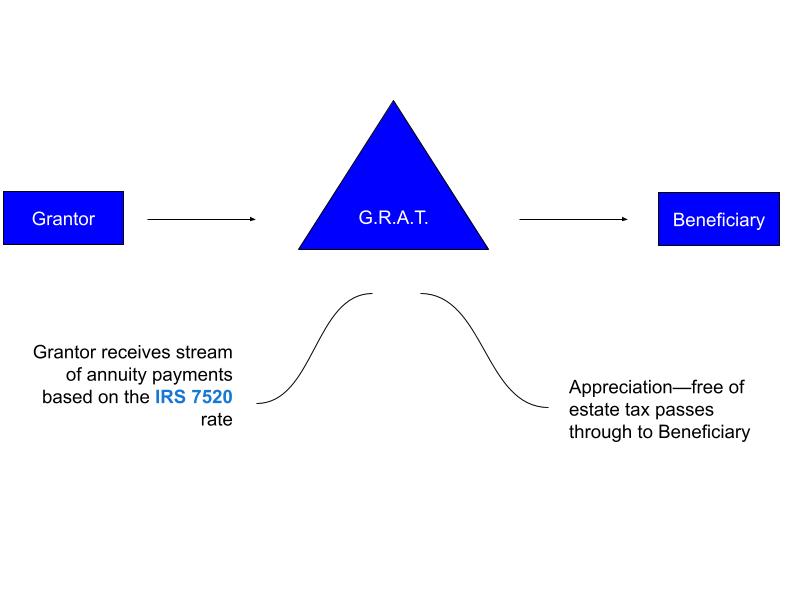

The third “Advanced Equity Planning Strategy” surrounds the Grantor Retained Annuity Trust (GRAT). A grantor retained annuity trust (GRAT) is a financial tool used in estate planning to reduce taxes on substantial monetary transfers to family members. An irrevocable trust is established for a specific term—or amount of time—under these plans. When a trust is founded, the person who establishes it pays a tax. Then the assets are deposited in the trust, and an annual annuity is paid out. When the trust ends, the assets are distributed to the recipient tax-free.

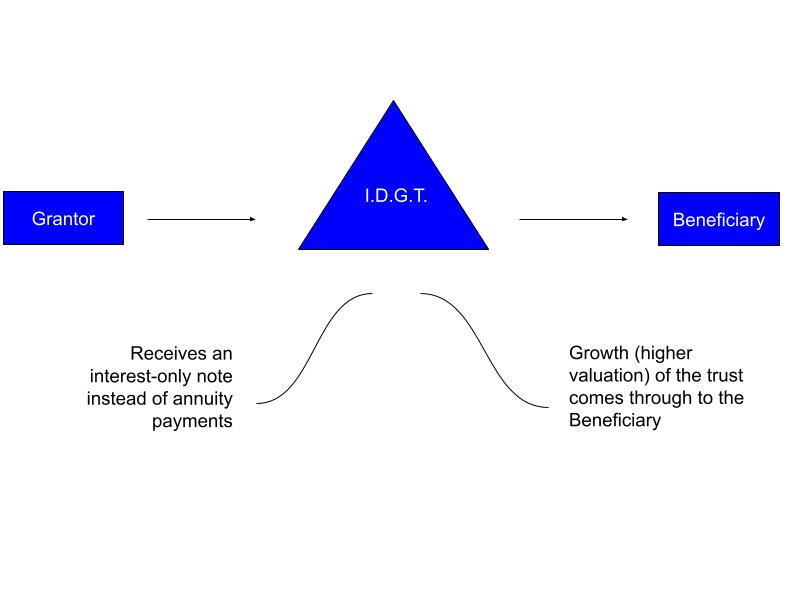

The fourth “Advanced Equity Planning Strategy” surrounds the Intentionally Defective Grantor Trust (IDGT). An intentionally defective grantor trust (IDGT) permits a trustor to separate income tax treatment from inheritance tax treatment on certain trust assets. This trust is set up with a “built-in” incentive that allows the grantor to keep making payments on income taxes concerning certain trust assets, even though those assets have been transferred from the individual. This strategy works because income tax laws do not acknowledge that those assets have been isolated.

This article does not constitute legal or tax advice. Please consult with your legal or tax advisor with respect to your particular circumstance.