Not sure if the stock you’re invested in is QSBS, learn more about our QSBS Monitoring Platform

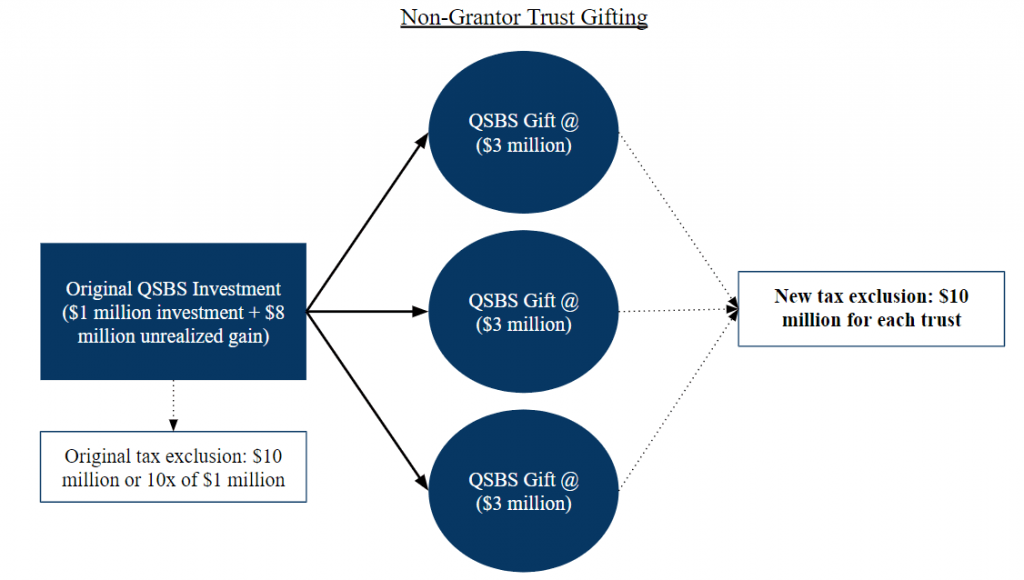

The IRC Section 1202 does not explicitly address transfers to trusts, but it can be implied that if the QSBS transfer is considered donative the QSBS will maintain its holding period and qualification. Under Section 1202(g) any common trust fund is eligible to be a holder of QSBS. There are two tax planning strategies, involving a grantor trust (controlled by the grantor) and a non-grantor trust (controlled by the donee or who the trust has been set up for). If the transfer is considered donative the grantor trust will maintain the QSBS qualification as if the transfer never happened. The more complex tax planning strategy involves a non-grantor trust. For example, an investor invested in an early-stage startup that turned out to be a unicorn investment. The investor creates three non-grantor trusts, one for each of his kids. The investor gifts each of his kids a third of the stock. Under Section 1202(h)(2) the donee of the gifted stock will maintain the full tax exclusion and holding period. Therefore, all three non-grantor trusts will have their own $10 million or 10x tax exclusion, allowing the original investor to create a myriad of tax exclusions.

Below is a hypothetical example of maximizing tax savings with a non-grantor trust.

This article does not constitute legal or tax advice. Please consult with your legal or tax advisor with respect to your particular circumstance.