On October 28, 2021 President Biden laid out his case for a scaled back version of the originally proposed $3.5T Build Back Better Act, reducing the cost to $1.75T.

The bill includes various tax reforms to generate the $1.75T needed, including the following:

https://www.whitehouse.gov/briefing-room/statements-releases/2021/10/28/president-biden-announces-the-build-back-better-framework/

The text of the bill details the full list of “pay for’s”, including keeping the amendment to make the Qualified Small Business Stock exclusion based on Adjusted Gross Income unchanged from the bills initial release in September. The bill is far from finalized and we will continue to monitor developments. If approved by Congress, the bill would likely move to the Senate for further revisions.

Refer to the “RULES COMMITTEE PRINT 117–17 TEXT OF H.R. 5376, BUILD BACK BETTER ACT” at https://rules.house.gov/sites/democrats.rules.house.gov/files/BILLS-117HR5376RH-RCP117-17.pdf (see page 1645 for the QSBS amendment).

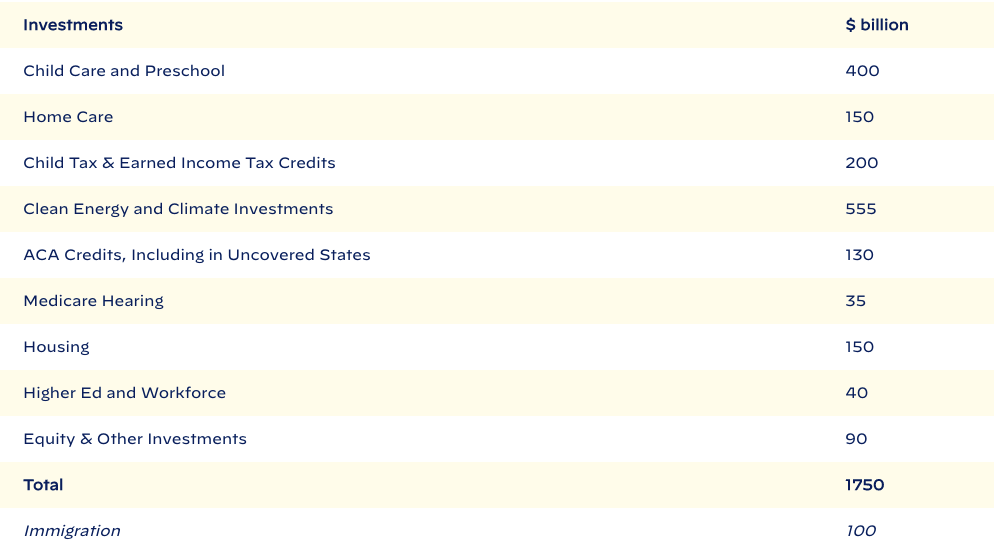

The scaled back bill includes the following key initiatives and their costs:

https://www.whitehouse.gov/briefing-room/statements-releases/2021/10/28/president-biden-announces-the-build-back-better-framework/

This article does not constitute legal or tax advice. Please consult with your legal or tax advisor with respect to your particular circumstance.