Earlier this month, the House Ways and Means Committee released their markups to the Build Back Better Act legislation that would help cover the American Jobs Plan and the American Families Plan. While the original proposal included verbiage that protected QSBS and its 100% tax exclusion, the current bill has included modification to Section 1202.

It’s almost as if the bill is finding pennies wherever they can to cover the cost of the ~$3.5 trillion bill. The Joint Committee on Taxation’s analysis predicts the revenue collected by their QSBS modification would amount to less than 1% of the total cost of the bill over 10 years.

According to the proposed amendment, there would only be a 50% QSBS exemption if,

“the adjusted gross income of such taxpayer (determined without regard to this section and sections 911, 931, and 933) equals or exceeds $400,000.”

Historically, the QSBS exclusion percentage has been based on when the QSBS was acquired starting with a 50% exclusion for stock acquired after August 10, 1993, but before February 17, 2009. The exclusion was elevated to 75% for stock acquired after February 17, 2009, but before September 27, 2010. And it was finally elevated to 100% (and later made permanent) for stock acquired after September 27, 2010.

These dates were the only factor necessary in determining the specific exclusion percentage allowable. But the newly released amendment adds in AGI as an additional factor.

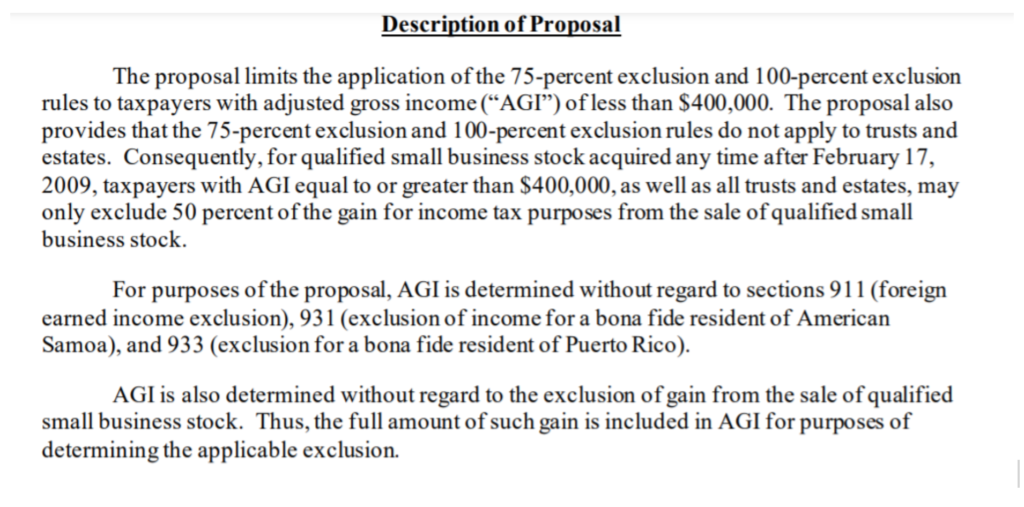

Accountants are scratching their heads at how to calculate AGI according to the new amendment and are working to unwind this seemingly circular reference – whereby you need to know the QSBS exclusion percentage in order to calculate AGI, however you need to know AGI (i.e. if over or under $400k) in order to know the QSBS exclusion percentage.

The Joint Committee on Taxation seems to clarify how this would be enacted in item #10 within this document. Specifically, under “Description of Proposal” (as shown below) the JCT notes “the full amount of such gain is included in AGI for purposes of determining the applicable exclusion.”

Therefore, the total capital gain from any QSBS eligible securities would be included in AGI and the QSBS exclusion would then be calculated after.

It remains unclear exactly how the non-excluded portion would be taxed, but if it is as before the amendment, it may be best to assume:

1) Capital Gains tax rate of 28% (per IRC Section 1(h)(4))

2) AMT add-back of 7% (per IRC Section 57(a)(7))

3) Net Investment Income Tax of 3.8%

This article does not constitute legal or tax advice. Please consult with your legal or tax advisor with respect to your particular circumstance.